扫描关注

扫描关注

Wechat:zkshichang

Email:bd@zkbc.net

Service:bd@zkbc.net

Address:Room 1301, 13th Floor, Building 11, District 4, Wangjing East Park, Chaoyang District, Beijing

Thank you for your attention. Feel free to contact us anytime

Corporate Scene

Corporate Scene

The business scenes extend to the upstream and downstream of the industrial chain. On the one hand, it helps companies solve financing difficulties and high financing costs, simplifying the approval process. On the other hand, it helps financial institutions acquire high-quality customers, control transaction data of enterprises, and manage risks related to fund usage.

Traffic Aggregation

Traffic Aggregation

Under Sino-Parsons, the "Baicaiyun" platform aggregates various types of cooperative channels and traffic, including but not limited to cooperative channels with banks, consumer finance channels, financial service channels, scenario-based cooperative channels, upstream and downstream partners, and other third-party cooperative channels.

Precise Selection

Precise Selection

Financial institutions can quickly connect with multiple cooperative channels through the Baicaiyun platform. Based on their own needs, they can accurately segment and select customers according to regional and specific customer group requirements, achieving maximized profits while meeting regulatory requirements

Intelligent Marketing

Intelligent Marketing

By leveraging cutting-edge technologies such as artificial intelligence, big data, and blockchain, Sino-Parsons empowers the marketing team with its data capabilities and digital tools. It innovates management models, performs precise customer segmentation, builds a closed-loop data insight system, enables quick access to multi-channel traffic, supplements user profiles, and filters and selects high-quality customers.

Marketing Control

Marketing Control

By using digital marketing methods to accurately acquire customers, conduct precise marketing, intelligently allocate suitable sales strategies, and implement end-to-end marketing control, Sino-Parsons significantly enhances its autonomous customer acquisition capabilities, helping banks achieve their business goals of attracting new customers and managing existing ones.

Corporate Scene

Corporate Scene

The business scenes extend to the upstream and downstream of the industrial chain. On the one hand, it helps companies solve financing difficulties and high financing costs, simplifying the approval process. On the other hand, it helps financial institutions acquire high-quality customers, control transaction data of enterprises, and manage risks related to fund usage.

Traffic Aggregation

Traffic Aggregation

Under Sino-Parsons, the "Baicaiyun" platform aggregates various types of cooperative channels and traffic, including but not limited to cooperative channels with banks, consumer finance channels, financial service channels, scenario-based cooperative channels, upstream and downstream partners, and other third-party cooperative channels.

Precise Selection

Precise Selection

Financial institutions can quickly connect with multiple cooperative channels through the Baicaiyun platform. Based on their own needs, they can accurately segment and select customers according to regional and specific customer group requirements, achieving maximized profits while meeting regulatory requirements

Intelligent Marketing

Intelligent Marketing

By leveraging cutting-edge technologies such as artificial intelligence, big data, and blockchain, Sino-Parsons empowers the marketing team with its data capabilities and digital tools. It innovates management models, performs precise customer segmentation, builds a closed-loop data insight system, enables quick access to multi-channel traffic, supplements user profiles, and filters and selects high-quality customers.

Marketing Control

Marketing Control

By using digital marketing methods to accurately acquire customers, conduct precise marketing, intelligently allocate suitable sales strategies, and implement end-to-end marketing control, Sino-Parsons significantly enhances its autonomous customer acquisition capabilities, helping banks achieve their business goals of attracting new customers and managing existing ones.

Sino-Parsons has built an intelligent risk control platform that covers the entire credit cycle and all scenarios, as well as a risk control system that covers the entire business process. It is suitable for both online and offline operations and covers the entire business process. The platform is characterized by being based on big data, supported by intelligent space, and driven by rule engines for decision-making.

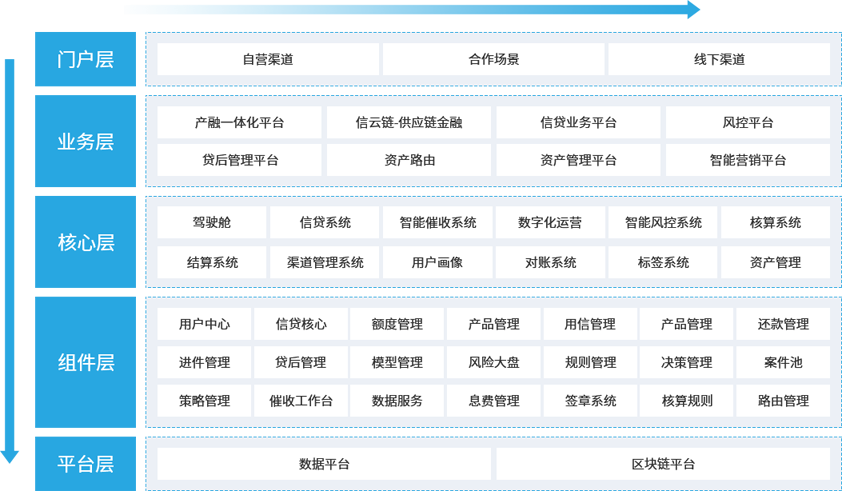

To meet the diverse operational needs of customers, Sino-Parsons constructs an all-in-one enterprise service platform to help financial institutions and corporate clients reduce operating costs and improve operational efficiency, thereby building an enterprise ecosystem.

Through the collaborative operational model of Sino-Parsons, partner banks can achieve business improvement and maximize profits. This model reduces personnel costs for banks, requires zero system investment, enables fast deployment, shortens implementation time, alleviates the technical integration pressure on banks, reduces the utilization of internal technological resources, and saves costs associated with bank systems. It solves the challenges of high technical difficulty and the need for extensive data accumulation, ensuring the provision of comprehensive business services including customer acquisition, risk control, and end-to-end operations for partner banks.

Sino-Parsons possesses strong capabilities in cutting-edge technologies such as artificial intelligence, big data, and blockchain. We tailor compliance, security, low-cost, high-performance, and highly available "technology + business" solutions for the institutions we serve, enabling digital transformation in various industries.

In the process of serving customers, with forward-looking technology, industry-savvy experts, and a top-notch product development team, we provide customers with products that fit their business needs, helping them maximize their value.

Artificial Intelligence

Artificial Intelligence

Cloud Computing

Cloud Computing

Blockchain

Blockchain

Privacy Computing

Privacy Computing

Knowledge Graph

Knowledge Graph

Artificial Intelligence combined with Big Data for deep integration in the financial industry

The AI platform covers algorithm-level, component-level, engine-level, and application-level full-stack capabilities of machine learning and deep learning

Enables hundreds of AI application operators such as knowledge graph, natural language processing, and predictive analytics

Based on cloud-native technologies such as K8S, containers, service mesh, and microservices, building a next-generation financial cloud architecture

Provides rapid adaptability and fault tolerance required for scenario-based finance

Highly elastic and capable of quickly responding to nonlinear traffic growth

Provides trusted computing environment, trusted data storage, trusted identity authentication, and trusted timestamping

Implements underlying implementation using cryptographic tools that meet national standards

Adopts a multi-chain parallel architecture to enhance performance, supporting throughput of 5000+ TPS (transactions per second)

Builds consortium chains and private chains in an out-of-the-box service manner

A ciphertext computing system built on self-developed secure multi-party computation technology

Performs calculations directly on encrypted data and obtains correct ciphertext computation results

Data does not need to be decrypted throughout the entire computation process, ensuring complete consistency between computation results based on ciphertext and plaintext

Realizes "usable but invisible, controllable and measurable" data

Real-time computing capability based on heterogeneous data sources, achieving millisecond-level performance for petabyte-level data

Utilizes a billion-node graph computing technology architecture, supporting millions of concurrent users, millisecond-level response, and massive graph data storage capacity

Utilizes secure multi-party computation and model fusion technology for data integration and modeling.